Do you want BuboFlash to help you learning these things? Or do you want to add or correct something? Click here to log in or create user.

Subject 5. Money Duration of a Bond and the Price Value of a Basis Point

#basic-concepts #cfa #cfa-level-1 #fixed-income #has-images #reading-56-understanding-fixed-income-risk-and-return

Modified duration measures the percentage price change of a bond to a change in its yield-to-maturity. Money duration measures the absolute price change.

Money Duration = Dirty Price x Modified Duration

P- is the full price calculated by lowering the yield-to-maturity by one basis point.

P+ is the full price calculated by raising the yield-to-maturity by one basis point.

To calculate absolute price change:

ΔDirty Price = - Money Duration x ΔYield

In the U.S., money duration is called dollar duration. It is the approximate dollar change in a bond's price for a 100 basis point change in yield.

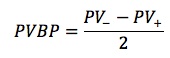

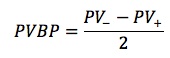

The price value of a basis point (PVBP) is the absolute change in the price of a bond for a one basis point change in yield. It is simply the money duration of a bond for a one basis point change in yield.

Example

Scott Marsh from Mass Avenue Research Management purchased a bond for a price of 93.555. This bond has a coupon of 14.70% and a modified duration of 3.00. Given market interest rates of 10.00% and a change in market rates of -66 basis points, what is the price value of a basis point?

The answer is the modified duration x 1 basis point x bond price or 3.00 x .0001 x 93.555 = $0.0281

Note: The other information has been placed into this question as a distraction. Don't be fooled by extraneous data!

To calculate PVBP:

P- is the full price calculated by lowering the yield-to-maturity by one basis point.

P+ is the full price calculated by raising the yield-to-maturity by one basis point.

If you want to change selection, open original toplevel document below and click on "Move attachment"

Summary

| status | not read | reprioritisations | ||

|---|---|---|---|---|

| last reprioritisation on | suggested re-reading day | |||

| started reading on | finished reading on |

Details

Discussion

Do you want to join discussion? Click here to log in or create user.